Your Piggyback-Portfolio

Almost no effort is required

Acquire your

Piggyback-Portfolio

Almost no effort is required

Buyers rely on three quality features

Liquidity – business model – purchase price

Exclusively … well funded startups

Fresh liquidity is available

Depending on the funding volume, startups have been enabled to secure the financing of subsequent stages and phases of growth.

So, for the time being, the future of all startups listed is financially secured.

Exclusively … startups with potential

Business models are tested

Business models of all those startups whose shares are offered have been reviewed by investors during the previous round of financing.

Buyers may join the investment round – even without any verification of your own.

Exclusively … quick negotiations

Purchase price is a market price

The current valuation (up to 90 days ago) determines the basis for the subsequent transaction between buyer and seller.

The present third-party evaluation ensures trust in an appropriate purchasing price.

Would you like more information first?

This way you can make a better decision.

You like to know more?

Leave us a message or call us: +49 (0)30-62937270.

* The information papers are aimed at large institutional and private investors and family offices

Information papers for large investors

We would be happy to send you further information on the following topics by post:

So that you can also discuss it as a team.

A double diversified entry into the startup markets

Aspects for large investors

Double diversification

Risk spreading on two levels

A piggyback portfolio achieves a high diversification on two levels, the level of the startups and the co-lead investors.

Such a diversification doubly minimizes your risk in a normally risky environment.

EU-wide industry reference

Startups as a market

Shares in startups are available across the EU. In this way you can cover sub-markets and sectors throughout Europe.

Industry-wide startup portfolios can be established within just a few months.

Ensured by a third-party expertise

Co-invest with experts

A passively managed portfolio is built up. You acquire shares in many of those startups, where experts recently invested.

The buyers follow professionals and their investment decisions.

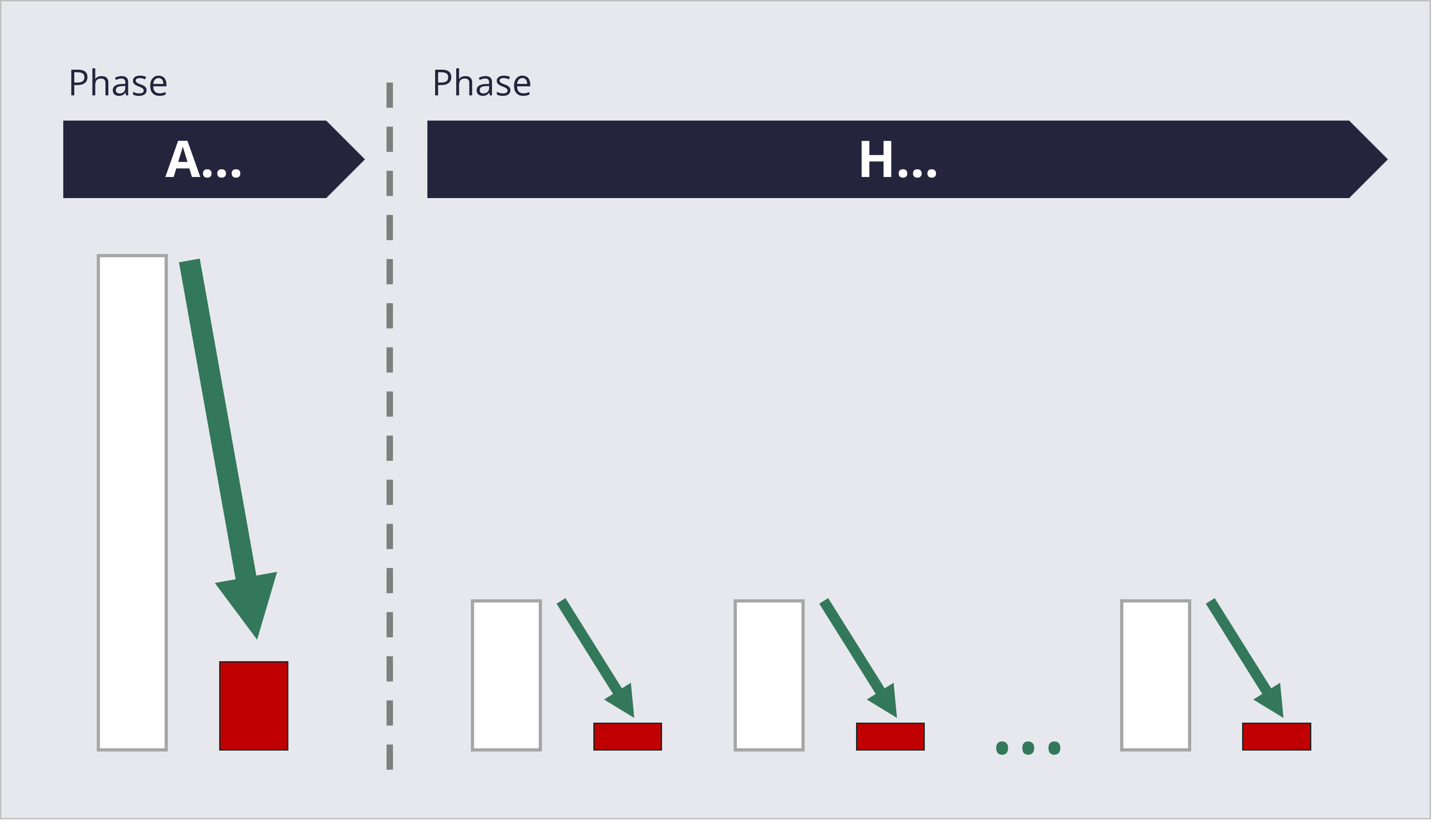

Create your own portfolio by using the piggyback method

Several investments. But almost no effort?

Almost no expenses

… in the acquisition phase

The buyer of the start-up shares can minimize the otherwise usual review and assessment costs, e.g. due diligence, when applying the 90-day rule. Legal DDs of the contracts will remain.

The buyer does not pay a commission fee. Once a transaction is completed, it is paid by the seller.

By relying on third-party expertise, you can keep transaction costs to a minimum.

In both phases

Much better – even permanently

Both, short and long-term cost benefits.

Almost no expenses

… in the holding phase

The usual management costs can also be kept to a minimum throughout the holding period, while the startup shares are monitored and held in the piggyback portfolio of the major investor.

In the simplest case, the buyer entrusts – in relation to his share – the major investor from the 90-day rule.

The expertise of those lead investor reduces individual decisions to a minimum.

Plan your market entry now

Co-invest in many industry startups with very little effort.

Call us on +49 (0)30 6293 7270 or email us.

The seller pays a performance-related commission

We only charge a commission if a sale is successful. Depending on the individual case, this is between 5 and 6% of the sales price. We will agree to the exact amount with you individually.

We will contact you after registration for everything else.